Investing in Bitcoin can be daunting for beginners who are skeptical of cryptocurrency exchanges or find them complicated. However, if you have experience with stock trading, investing in Bitcoin becomes easier. By using your preferred stock trading app, you can search for the following ETFs in the US market:

BITO, BLOK, BTF, BKCH, BITI, and more.

Notably, BlackRock's application for spot BItcoin ETFs and the anticipation of its approval have attracted significant institutional investments into BITO.

Find the right product for your investment strategy.

1. BITO (ProShares Bitcoin Strategy ETF):

BITO, widely recognized as ProShares' representative Bitcoin ETF, tracks the Bitcoin futures index. It is considered an excellent investment option, with a current dividend yield of 9%.

Issuer: ProShares

Assets Under Management: $1,072.6 million Expense Ratio: 0.95%

Last Dividend Date: June 1, 2023

Annual Dividend: $1.56

Annual Dividend Yield: 9.07%

2. BITX (2X Bitcoin Strategy ETF):

For those who believe in the promising future of Bitcoin, there is a leverage product available. However, note that the expense ratio is higher.

Issuer: Penserra Capital Management

Assets Under Management: $5.7 million

Expense Ratio: 1.85%

Last Dividend Date: N/A

Annual Dividend: N/A

Annual Dividend Yield: N/A

3. BLOK (Amplify Transformational Data Sharing ETF):

If you wish to invest in various blockchain-related stocks, BLOK is an ideal ETF option.

Issuer: Amplify Investments

Assets Under Management: $506.9 million Expense Ratio: 0.75%

Last Dividend Date: December 29, 2021

Annual Dividend: N/A

Annual Dividend Yield: N/A

Holdings: Includes MicroStrategy and other blockchain-related stocks

4. BKCH (Global X Blockchain ETF):

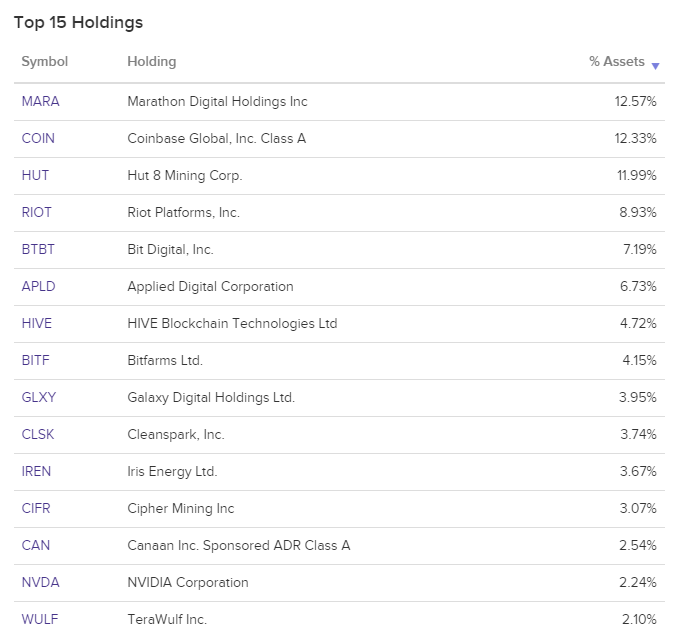

BKCH allows you to invest in a range of Bitcoin and blockchain-related stocks through a single ETF. It is issued by Mirae Asset Global Investments.

Issuer: Mirae Asset Global Investments Assets Under Management: $83.2 million

Expense Ratio: 0.5%

Last Dividend Date: June 29, 2023

Annual Dividend: $0.22

Annual Dividend Yield: 0.71%

Holdings: Includes Coinbase and other blockchain-related stocks

5. BITI (ProShares Short Bitcoin Strategy ETF):

If you are not a Bitcoin enthusiast and believe Bitcoin holds no value, there is a short product available.

Issuer: ProShares

Assets Under Management: $80.2 million Expense Ratio: 0.95%

Last Dividend Date: June 1, 2023

Annual Dividend: $0.15

Annual Dividend Yield: 0.82%

Explore the key ETFs related to Bitcoin listed in the US market and select the product that aligns with your investment strategy. Investing in Bitcoin through ETFs provides a more accessible and familiar avenue for beginners, especially those with prior experience in stock trading. Keep an eye on the developments in the cryptocurrency market and make informed investment decisions.